Welcome to our comprehensive guide on “Buyer Requirements.” In today’s competitive market, understanding and meeting buyer needs is crucial for business success. Whether you’re a seasoned entrepreneur or just starting, this article will delve into the key aspects of buyer requirements and equip you with valuable insights to enhance your approach. So, let’s begin our journey into understanding and fulfilling the Buyer Requirements.

Buyer Requirements: An Overview

Buyer Requirements refer to the specific expectations, demands, and criteria potential customers have when considering a product or service. To establish a strong presence in the market, businesses must identify and address these requirements effectively. Meeting buyer requirements not only fosters customer satisfaction but also establishes long-term relationships, promotes positive word-of-mouth, and contributes to business growth.

Understanding the Buyer Persona

The foundation of meeting buyer requirements lies in comprehending the buyer persona. The buyer persona is a detailed representation of your ideal customer, based on research and real data. It encompasses demographic information, preferences, pain points, motivations, and buying behaviors. By creating a well-defined buyer persona, you can tailor your products, marketing strategies, and customer service to cater to the specific needs of your target audience.

Conducting In-Depth Market Research

Market research plays a pivotal role in understanding the ever-changing landscape of buyer requirements. Through market research, you can gather valuable data about your competitors, industry trends, and customer feedback. Utilize various research methods such as surveys, interviews, and online analytics to gain valuable insights into buyer preferences, emerging trends, and pain points.

Crafting a Customer-Centric Approach

A customer-centric approach focuses on delivering exceptional customer experiences by prioritizing their needs and preferences. Ensure that every touchpoint with your customers, be it your website, social media, or customer support, aligns with their expectations. By embracing a customer-centric culture, you can foster loyalty, drive repeat business, and attract new customers through positive reviews and referrals.

Customizing Products and Services

Personalization is the key to fulfilling buyer requirements effectively. Today’s customers seek products and services tailored to their unique needs. Leverage data-driven analytics and customer feedback to customize your offerings. Whether it’s product features, pricing plans, or service packages, providing personalized options can significantly enhance customer satisfaction.

Implementing Agile Business Strategies

Agility is essential in a dynamic business landscape. Embrace flexibility in your business strategies to respond promptly to changing buyer requirements. Regularly evaluate and adapt your products, services, and marketing efforts based on customer feedback and market trends.

The Role of Customer Support

Prompt and efficient customer support is vital in meeting buyer requirements. Establish a robust customer support system that addresses queries, concerns, and issues in a timely and satisfactory manner. Invest in training your support team to provide empathetic and knowledgeable assistance to customers.

Leveraging Technology and Automation

Incorporate technology and automation to streamline processes and improve the overall customer experience. Utilize customer relationship management (CRM) software to manage customer interactions effectively. Automation can also assist in personalized email marketing campaigns, order processing, and inventory management.

Transparency and Trustworthiness

Transparency builds trust, which is a fundamental aspect of meeting Buyer Requirements. Be open about your products, pricing, and policies. Avoid misleading advertisements or false promises. Cultivate trust among your customers, as it can lead to repeat purchases and brand loyalty.

The Impact of Reviews and Testimonials

In the digital age, online reviews and testimonials significantly influence purchasing decisions. Encourage satisfied customers to leave reviews and testimonials on platforms like Google, Yelp, or your website. Respond to both positive and negative reviews with professionalism and empathy. Addressing negative feedback shows your commitment to customer satisfaction.

Building a Seamless User Experience

User experience (UX) directly impacts buyer requirements. Ensure that your website and mobile app are user-friendly, visually appealing, and intuitive. Smooth navigation, fast-loading pages, and clear calls-to-action can enhance the overall user experience and increase conversion rates.

Effective Content Marketing Strategies

Content marketing is a powerful tool for meeting buyer requirements. Develop valuable and informative content that addresses your audience’s pain points, interests, and questions. Use a mix of blogs, videos, infographics, and social media posts to engage with potential customers and establish your authority in the industry.

Sustainability and Social Responsibility

In recent years, customers have become more conscious of sustainable and socially responsible practices. Demonstrate your commitment to environmental and social causes by adopting eco-friendly practices, supporting charitable initiatives, and communicating your efforts transparently.

Influencer Marketing and Partnerships

Collaborating with influencers and strategic partnerships can expand your reach and credibility. Identify influencers who align with your brand values and have a significant following in your target market. Partnering with reputable organizations can also build trust and foster brand recognition.

Leveraging Data Analytics for Growth

Data analytics empowers businesses to make data-driven decisions and optimize their strategies. Monitor and analyze customer behavior, sales patterns, and marketing campaigns. Use these insights to refine your approach and identify new opportunities for growth.

Building a Strong Online Presence

An impressive online presence is essential in today’s digital age. Invest in search engine optimization (SEO) to improve your website’s visibility in search engine results. Create engaging social media profiles and regularly post relevant content to connect with your audience.

Cultivating Brand Loyalty

Brand loyalty leads to repeat purchases and customer advocacy. Offer loyalty programs, exclusive offers, and personalized incentives to reward repeat customers. Engage with your loyal customers through email marketing and special events to make them feel valued.

The Role of Emotions in Buying Decisions

Emotions play a significant role in purchasing decisions. Understand your customers’ emotional triggers and incorporate them into your marketing campaigns. Create emotional connections through storytelling, empathy, and relatable content.

Building a Strong Customer Feedback Loop

A customer feedback loop is essential for continuous improvement. Encourage customers to provide feedback through surveys, reviews, and feedback forms. Act on their suggestions and communicate the changes you implement based on their feedback.

Leveraging Social Proof

Social proof, such as testimonials, case studies, and user-generated content, can significantly influence buyer decisions. Showcase positive experiences shared by your customers to build trust and credibility.

Nurturing Leads and Converting Sales

Lead nurturing is the process of building relationships with potential customers and guiding them through the sales funnel. Develop personalized lead nurturing campaigns that provide value and address specific pain points.

Securing Payment and Data Protection

Ensure a secure payment gateway and robust data protection measures. Customers value their privacy, and a strong emphasis on data security can enhance their trust in your business.

FAQs

What are Buyer Requirements?

Buyer Requirements are the specific expectations and criteria potential customers have when considering a product or service.

Why is Understanding the Buyer Persona Important?

Understanding the buyer persona helps tailor products, marketing strategies, and customer service to cater to the specific needs of the target audience.

How can I Implement Agile Business Strategies?

Regularly evaluate and adapt your products, services, and marketing efforts based on customer feedback and market trends.…

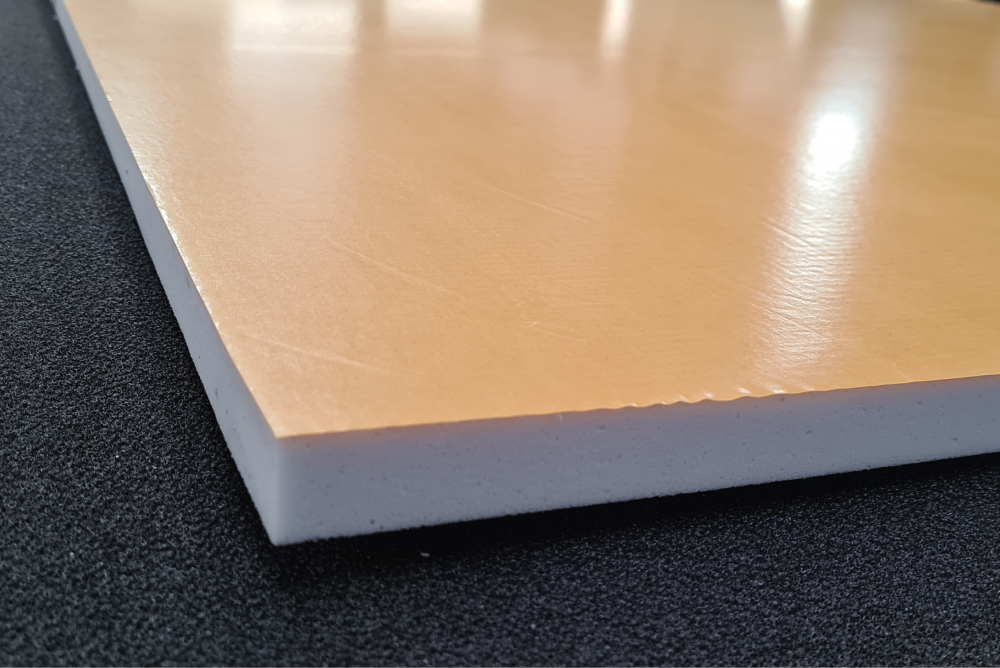

Select Any Mattress Together with Temperature Level of sensitivity Not every polyurethane foam mattress that can be found, on industry, will become sensitive to be able to temperature. Yet, temperature sensitivity is probably the most important features that produces a polyurethane foam mattress thus unique therefore downright secure. When searching for a bed, if it is possible to buy the one that adjusts for the temperature, please do this. You will see that the particular mattress can absorb your system heat and also soften upwards. The same does work when the surroundings is much cooler, the mattress can be firmer. You can check regarding temperature level of sensitivity. Just spot a zero lock carrier of ice about it for a couple minutes and it’ll be much firmer beneath the ice as compared to on other mattress. Decide on a Mattress With all the Correct Thickness. One with the main facts to consider, when choosing the proper saltele memory foam, could be the density with the memory foam. The density with the memory foam serves as a fat, of the particular mattress, measured in the cubic ft. of polyurethane foam. For illustration, if you’re to cut an item of memory foam in to a 12 x12 times 12 model of a cube, or large dice, and also take the weight, the producing weight could be its thickness. There are usually various ideas, whirling around on the market, about which can be the appropriate density of your saltele memory foam to choose. Some bed sellers will try to sell you something in the 3 lb. density array. However, it is advisable to decide on a saltele memory foam among densities regarding 5. 0-5. 9 lb., because with densities below 5. 0, the saltele are not going to support your spine, shoulders and also hips. Over and above the thickness of 5. 9, saltele memory foam will probably be too dense allowing for appropriate support. If you’d prefer a futon, that’s what it could feel like as of this density. Decide on a Mattress Together with Enough Leading Layer When venturing out to obtain a saltele memory foam, you will need to select the one that has enough polyurethane foam at the top layer. Usually it’s always best to get any mattress that is manufactured with no less than 3. 5 ins of polyurethane foam as the top level. The significance about selecting any mattress with all the correct fullness of polyurethane foam on leading, cannot become stressed adequate. If this kind of layer will be too slender, then anyone ends upwards sleeping, to some extent, on the particular underlying polyurethane foam, and runs the chance of a distressing night’s slumber. Select Any Mattress Beneath Warranty Another good plan when choosing the saltele memory foam is always to buy one using a warranty. Buying something under any warranty isn’t only a good plan for any mattress but also for anything generally speaking. These saltele are available with any 20-25 year limited warrantee, giving you the opportunity to have virtually any defects restored or hold the item swapped out. Having any warranty on your own saltele memory foam will make you feel greater about acquiring one. Total, this may seem like plenty of information to be able to digest, but keeping these guidelines in brain, when picking your polyurethane foam mattress Business Supervision Articles, can make it easier so that you can decide on the right choice for your preferences. Getting a fantastic night’s slumber is too crucial that you sleep on whatever else but a polyurethane foam mattress!…

Select Any Mattress Together with Temperature Level of sensitivity Not every polyurethane foam mattress that can be found, on industry, will become sensitive to be able to temperature. Yet, temperature sensitivity is probably the most important features that produces a polyurethane foam mattress thus unique therefore downright secure. When searching for a bed, if it is possible to buy the one that adjusts for the temperature, please do this. You will see that the particular mattress can absorb your system heat and also soften upwards. The same does work when the surroundings is much cooler, the mattress can be firmer. You can check regarding temperature level of sensitivity. Just spot a zero lock carrier of ice about it for a couple minutes and it’ll be much firmer beneath the ice as compared to on other mattress. Decide on a Mattress With all the Correct Thickness. One with the main facts to consider, when choosing the proper saltele memory foam, could be the density with the memory foam. The density with the memory foam serves as a fat, of the particular mattress, measured in the cubic ft. of polyurethane foam. For illustration, if you’re to cut an item of memory foam in to a 12 x12 times 12 model of a cube, or large dice, and also take the weight, the producing weight could be its thickness. There are usually various ideas, whirling around on the market, about which can be the appropriate density of your saltele memory foam to choose. Some bed sellers will try to sell you something in the 3 lb. density array. However, it is advisable to decide on a saltele memory foam among densities regarding 5. 0-5. 9 lb., because with densities below 5. 0, the saltele are not going to support your spine, shoulders and also hips. Over and above the thickness of 5. 9, saltele memory foam will probably be too dense allowing for appropriate support. If you’d prefer a futon, that’s what it could feel like as of this density. Decide on a Mattress Together with Enough Leading Layer When venturing out to obtain a saltele memory foam, you will need to select the one that has enough polyurethane foam at the top layer. Usually it’s always best to get any mattress that is manufactured with no less than 3. 5 ins of polyurethane foam as the top level. The significance about selecting any mattress with all the correct fullness of polyurethane foam on leading, cannot become stressed adequate. If this kind of layer will be too slender, then anyone ends upwards sleeping, to some extent, on the particular underlying polyurethane foam, and runs the chance of a distressing night’s slumber. Select Any Mattress Beneath Warranty Another good plan when choosing the saltele memory foam is always to buy one using a warranty. Buying something under any warranty isn’t only a good plan for any mattress but also for anything generally speaking. These saltele are available with any 20-25 year limited warrantee, giving you the opportunity to have virtually any defects restored or hold the item swapped out. Having any warranty on your own saltele memory foam will make you feel greater about acquiring one. Total, this may seem like plenty of information to be able to digest, but keeping these guidelines in brain, when picking your polyurethane foam mattress Business Supervision Articles, can make it easier so that you can decide on the right choice for your preferences. Getting a fantastic night’s slumber is too crucial that you sleep on whatever else but a polyurethane foam mattress!…